Deep beneath our feet lies a revolutionary energy source that’s reshaping global power dynamics. Gas shale – once considered impossible to extract – now supplies 25% of U.S. natural gas. But how does this remarkable rock formation work, and is it truly the ‘bridge fuel’ to our clean energy future?”

Table of Contents

What Is Gas Shale?

Gas shale isn’t just ordinary rock it’s a fine-grained sedimentary rock that’s formed from the compression of silt and clay-size mineral particles over millions of years. But what makes it special isn’t its composition, but what’s trapped within it.

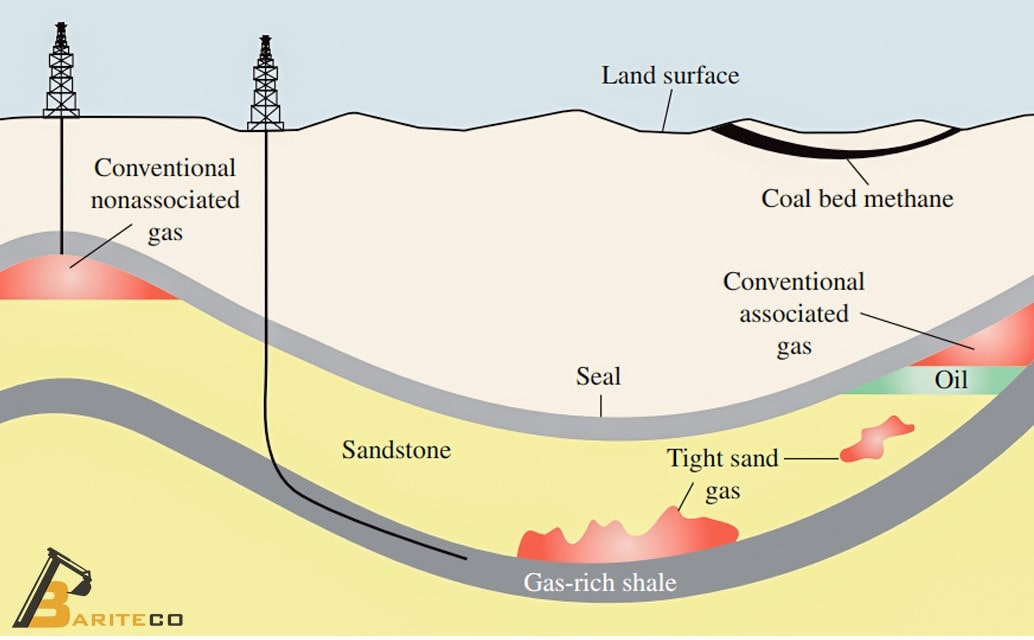

Unlike conventional natural gas deposits that collect in relatively porous reservoir rocks, shale gas is dispersed throughout the tight rock formation itself. Think of conventional gas as water in a sponge that can easily flow out, while shale gas is more like moisture trapped in a brick it’s there, but you need special techniques to extract it.

The gas found in these formations is primarily methane, the same component that makes up conventional natural gas. However, the key difference lies in how tightly this gas is held within the rock’s matrix. This is why gas shale remained largely untapped until recent technological advances made extraction economically viable.

Geological Formation and Characteristics

The story of gas shale begins millions of years ago when ancient seas covered much of what is now dry land. As organic matter from prehistoric marine life settled on the sea floor, it mixed with clay and silt particles. Over time, these sediments were buried deeper and deeper, subjected to increasing heat and pressure the perfect conditions for transforming organic material into hydrocarbons.

What makes shale formations unique is their extremely low permeability. While conventional reservoir rocks might have permeability measured in hundreds of millidarcies (a unit for measuring how easily fluids flow through rock), shale permeability is often measured in nanodarcies a million times less permeable! This extremely tight structure is what has historically made shale gas difficult to extract.

| Characteristic | Description | Significance |

| Grain Size | Extremely fine (less than 0.004 mm) | Creates very tight rock with low permeability |

| Organic Content | High (typically 2-10% TOC) | Source of gas generation |

| Permeability | Very low (nanodarcies) | Requires fracturing to extract gas |

| Natural Fractures | Present in varying degrees | Can enhance gas flow |

| Clay Mineral Content | Significant | Affects mechanical properties and fracturing response |

| Structure | Layered or “laminated” | Creates planes of weakness for fracturing |

These properties create both the blessing of gas storage and the curse of difficult extraction. It’s a bit like having money locked in a safe without the combination valuable, but inaccessible without the right tools.

Difference Between Conventional and Unconventional Gas Resources

When energy professionals talk about “unconventional” gas resources like shale gas, they’re not commenting on how unusual the gas itself is it’s still primarily methane. Rather, they’re referring to the extraction methods required and the nature of the reservoir.

Conventional gas deposits typically occur in relatively porous, permeable reservoir rocks like sandstone. The gas migrates from source rocks (often shale) into these reservoirs, where it becomes trapped beneath an impermeable cap rock. Drilling into these formations releases pressure, allowing the gas to flow naturally to the surface.

With gas shale, however, the source rock and reservoir rock are one and the same. The gas remains trapped within the tight shale formation and won’t flow naturally when drilled into. This fundamental difference necessitates different extraction approaches:

| Characteristic | Conventional Gas | Shale Gas |

| Reservoir Type | Porous sandstone, limestone | Tight, impermeable shale |

| Gas Flow | Relatively free-flowing | Restricted flow requiring stimulation |

| Well Design | Typically vertical | Horizontal drilling common |

| Extraction Method | Standard drilling | Hydraulic fracturing required |

| Development Cost | Lower per well | Higher per well |

| Production Decline | Gradual | Steep initial decline |

| Field Lifespan | Longer | Shorter unless restimulated |

The History of Gas Shale Development

The story of gas shale isn’t one of sudden discovery these formations have been known for centuries. Rather, it’s a tale of technological persistence, economic necessity, and innovative thinking that transformed our global energy landscape.

Early Discoveries and Utilization

Would you believe that the first commercial natural gas well in the United States, drilled in Fredonia, New York in 1821, was actually producing from a shale formation? Early settlers noticed natural gas seeping from outcrops and realized its potential as an energy source. However, these early efforts took advantage of naturally fractured shales where some gas could flow without advanced stimulation techniques.

For most of the 19th and 20th centuries, shale formations were largely bypassed in favor of easier-to-produce conventional gas deposits. Geologists understood that these shales contained gas, but the technology to extract it economically simply didn’t exist.

Shale formations were primarily viewed as source rocks that generated hydrocarbons that migrated to more accessible conventional reservoirs, or as cap rocks that trapped gas in those reservoirs. The U.S. Department of Energy actually began research into shale gas extraction methods in the 1970s, driven by concerns about declining domestic energy production. This early research laid important groundwork for later commercial developments, but economic extraction remained elusive.

| Year | Milestone | Significance |

| 1821 | First commercial gas well in Fredonia, NY | Produced from naturally fractured shale formation |

| 1860s-1920s | Small-scale shale gas production | Limited to areas with natural fractures |

| 1970s | U.S. Department of Energy initiates research | Eastern Gas Shales Project starts exploring potential |

| 1981 | First tax credit for unconventional gas | Section 29 tax credit encourages experimentation |

| 1986 | First Barnett Shale well by Mitchell Energy | Beginning of persistent development efforts |

| 1991 | First horizontal well in Barnett Shale | Early attempt at horizontal drilling techniques |

- 1821: First commercial natural gas well in the United States, in Fredonia, New York, produces from shale formation

- 1970s: Energy crisis prompts U.S. Department of Energy to begin research into shale gas extraction methods

- 1981: Section 29 tax credits introduced for unconventional gas development

- 1986-1997: Mitchell Energy begins persistent experimentation in the Barnett Shale

The Shale Revolution: Technological Breakthroughs

The real game-changer came in the late 1990s and early 2000s, when a perfect storm of technological innovation, high natural gas prices, and entrepreneurial spirit converged. The pioneer of this revolution was George P. Mitchell, whose company Mitchell Energy persistently experimented with techniques to extract gas from the Barnett Shale in Texas.

After years of trial and error, Mitchell’s team developed effective methods for hydraulic fracturing specifically tailored to shale formations. When this was combined with advances in horizontal drilling technology, the economic equation suddenly changed. What had been considered unrecoverable resources became not just accessible, but profitable.

The results were dramatic. U.S. natural gas production, which had been declining for years, suddenly reversed course. Between 2005 and 2019, U.S. dry natural gas production increased by more than 80%, primarily due to shale gas development. This transformed America from a nation expecting to import increasing amounts of natural gas to one that became a major exporter.

| Year | Technological Breakthrough | Impact on Shale Development |

| 1997 | First successful slickwater frac in Barnett Shale | Demonstrated economic viability of shale gas production |

| 1998-2002 | Refinement of hydraulic fracturing techniques | Improved production rates and economics |

| 2002-2003 | Combination of horizontal drilling with multi-stage fracking | Dramatic increase in well productivity |

| 2005 | Devon Energy acquires Mitchell Energy | Accelerated application of technologies |

| 2007-2008 | Techniques applied to Marcellus Shale | Expansion of shale revolution to Appalachia |

| 2008-2010 | Pad drilling development | Reduced surface footprint and development costs |

Horizontal Drilling Innovations

I can’t overstate how important horizontal drilling has been to the shale revolution. Traditional vertical wells could only access the limited thickness of a shale layer they passed through typically 50-300 feet. Horizontal drilling changed the game by allowing a single well to run laterally through the shale layer for thousands of feet, exponentially increasing the contact area with the gas-bearing formation.

Think of it this way: if you’re trying to drink a milkshake, a vertical well is like a straw placed straight down into your glass you can only access what’s directly below. Horizontal drilling is like bending your straw to run along the bottom of the glass, accessing much more of the drink with a single straw.

Hydraulic Fracturing Evolution

The history of hydraulic fracturing actually dates back further than many realize. The first commercial application of hydraulic fracturing occurred in 1949 when Halliburton and Stanolind Oil performed treatments in Oklahoma and Texas. However, these early fracs were vastly different from modern operations, using far less fluid and pressure while delivering modest results.

What makes the shale revolution truly remarkable is not that hydraulic fracturing was invented it’s that engineers like those at Mitchell Energy persistently refined, adapted, and optimized the technique specifically for shale formations, ultimately transforming it from an occasional well stimulation method to the cornerstone of an energy revolution.

Major Gas Shale Formations Worldwide

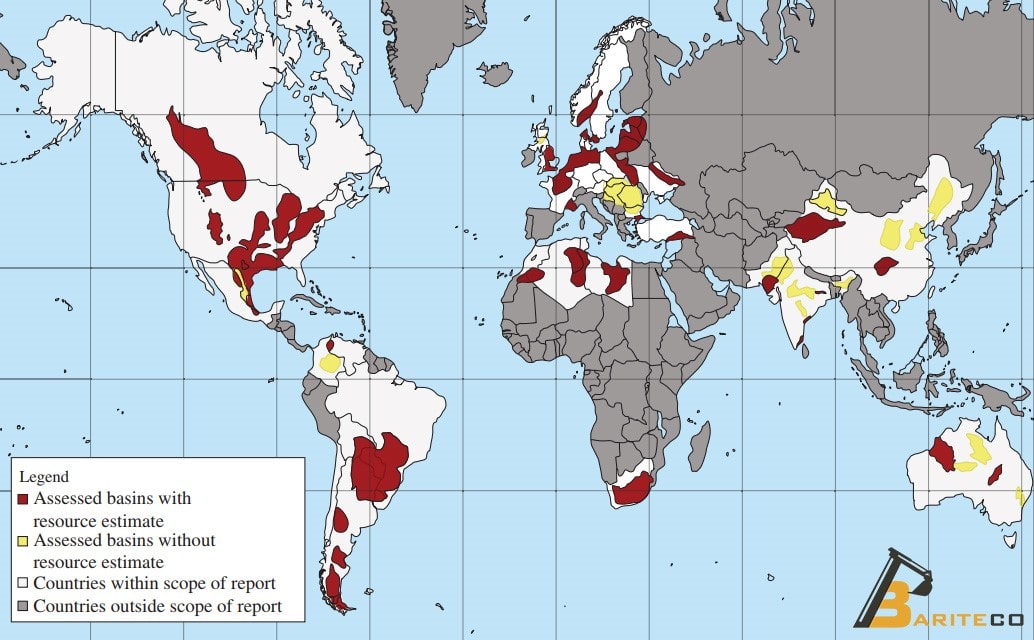

The global energy landscape has been fundamentally transformed by the identification and development of gas shale formations across the world. Shale gas resources are not limited to North America they’re found on every continent, though development stages vary widely. Understanding these formations is crucial for energy analysts, investors, and policymakers navigating the changing dynamics of global energy markets.

While the United States has led the shale revolution, significant resources exist globally. China possesses the world’s largest technically recoverable shale gas resources, followed by Argentina, Algeria, and Canada. However, technical recoverability doesn’t always translate to economic viability factors including geological complexity, water availability, infrastructure access, regulatory frameworks, and market conditions all impact development potential.

What makes shale formations unique is their dual role as both source rock and reservoir rock. Unlike conventional gas deposits, where hydrocarbons migrate from source rocks to more permeable reservoir rocks, shale gas remains trapped in the very low-permeability formation where it was generated. This characteristic presents both challenges and opportunities for extraction.

| Region | Estimated Gas Resources (Tcf) | Notable Formations | Development Status |

| North America | 1,181 | Marcellus, Barnett, Haynesville, Eagle Ford | Advanced commercial production |

| South America | 1,431 | Vaca Muerta (Argentina), Los Molles | Early commercial development |

| Europe | 883 | Baltic Basin, Paris Basin, North Sea-German Basin | Limited exploration, varying regulatory restrictions |

| Asia | 1,808 | Sichuan Basin, Tarim Basin, Songliao Basin | Early commercial development (China) |

| Africa | 1,361 | Karoo Basin, Ghadames Basin | Exploration phase |

| Australia | 429 | Cooper Basin, Perth Basin | Early exploration and assessment |

North American Shale Plays

North America particularly the United States stands at the forefront of the shale gas revolution. The continent hosts numerous productive shale plays, each with unique geological characteristics, production profiles, and development challenges. The successful exploitation of these resources has fundamentally altered the North American energy landscape, transforming the United States from a nation anticipating increased natural gas imports to becoming a significant exporter.

The development of North American shale plays has progressed through several phases. Early efforts focused on areas like the Barnett Shale, where experimentation with hydraulic fracturing and horizontal drilling techniques eventually led to commercial viability. This success catalyzed rapid expansion into other formations, including the massive Marcellus Shale in the Appalachian Basin and the Haynesville Shale along the Gulf Coast.

Marcellus Shale: The Giant of the East

The Marcellus Shale formation represents one of the most significant natural gas resources in North America, underlying a vast area of the Appalachian Basin stretching across Pennsylvania, West Virginia, New York, Ohio, and parts of Maryland. Named after a distinctive outcrop near the village of Marcellus, New York, this Middle Devonian-age formation has transformed the energy economics of the northeastern United States.

| Parameter | Value | Unit |

| Depth Range | 4,000-8,500 | feet |

| Thickness | 50-250 | feet |

| Area | 95,000 | square miles |

| Gas-in-Place | 500+ | trillion cubic feet |

The Marcellus formation consists primarily of black, organic-rich shale deposited roughly 390 million years ago in a shallow inland sea. Its high organic content (Total Organic Carbon often exceeding 3%) makes it exceptionally productive as a hydrocarbon source. What distinguishes the Marcellus is not just its vast size but also its strategic location near major Northeastern population centers and industrial markets, providing significant logistical advantages.

Despite being known to geologists for generations, the true potential of the Marcellus remained untapped until the combination of horizontal drilling and hydraulic fracturing techniques pioneered in the Barnett Shale were applied here. Since commercial development began in earnest around 2008, production has grown at an astounding rate, transforming the region into one of the world’s most productive natural gas basins.

| Parameter | Western Marcellus | Central Marcellus | Eastern Marcellus |

| Thermal Maturity (Ro%) | 0.8-1.2 (Wet Gas) | 1.2-2.0 (Dry Gas) | 2.0+ (Dry Gas) |

| Porosity (%) | 4-7 | 5-8 | 3-6 |

| TOC (%) | 2-4 | 3-10 | 2-5 |

| Average EUR per Well (Bcf) | 4-8 | 10-25 | 8-15 |

| Primary Operators | Range Resources, EQT | Cabot, Chesapeake | Southwestern, Antero |

The economic impact of Marcellus development has been profound. Pennsylvania alone has seen tens of thousands of new jobs created, billions in royalty payments to landowners, and significant tax revenue generation. However, development has not been without controversy, with concerns regarding water usage, potential groundwater impacts, and infrastructure strain in previously rural areas.

Barnett Shale: Where It All Began

The Barnett Shale, located in the Fort Worth Basin of North Texas, holds a special place in the history of unconventional gas development. It represents the birthplace of the modern shale gas revolution, where pioneering efforts by Mitchell Energy in the 1980s and 1990s eventually cracked the code for economically producing natural gas from tight shale formations.

| Parameter | Value | Unit |

| Depth Range | 6,500-8,500 | feet |

| Thickness | 100-600 | feet |

| Area | 5,000 | square miles |

| Gas-in-Place | 200+ | trillion cubic feet |

Historical Significance

Named after John W. Barnett who discovered the formation in the early 1900s, the Barnett Shale remained largely unproductive for nearly a century. The formation’s tight, low-permeability characteristics made conventional production methods ineffective. However, everything changed when George P. Mitchell, founder of Mitchell Energy & Development, persisted through nearly two decades of experimentation with hydraulic fracturing techniques.

In 1997, Mitchell Energy’s S.H. Griffin well demonstrated the commercial viability of the “slick water frac” technique in the Barnett, triggering what would eventually become a global revolution in energy production. This technological breakthrough combining horizontal drilling with high-volume hydraulic fracturing provided the template for all subsequent shale gas development worldwide.

Global Shale Formations

While the Barnett Shale pioneered commercial shale gas production technology, numerous significant shale formations exist worldwide. Global shale resources are estimated to contain approximately 7,600 trillion cubic feet of technically recoverable natural gas and 420 billion barrels of technically recoverable shale oil, according to assessments by the U.S. Energy Information Administration (EIA).

| Region | Major Shale Formations | Est. Resources (Tcf Gas) | Est. Resources (Bbbl Oil) | Development Status |

| North America | Marcellus, Eagle Ford, Haynesville, Bakken | 1,685 | 78 | Advanced Commercial |

| South America | Vaca Muerta, Neuquén Basin, Paraná Basin | 1,431 | 61 | Early Commercial |

| Europe | Baltic Basin, Paris Basin, North Sea-German Basin | 883 | 14 | Exploration |

| Asia | Sichuan Basin, Tarim Basin, Junggar Basin | 1,808 | 77 | Early Commercial |

| Australia | Cooper Basin, Perth Basin, Canning Basin | 429 | 18 | Early Commercial |

| Africa | Karoo Basin, Ghadames Basin, Sirte Basin | 1,361 | 170 | Early Exploration |

North America: Contains 22% of global shale gas resources

North America leads global shale development with the most advanced commercial operations. The Marcellus Shale in the Appalachian Basin is the largest shale gas play in the United States, spanning Pennsylvania, West Virginia, Ohio, and New York. The Eagle Ford in Texas produces significant volumes of both oil and gas, while the Bakken in North Dakota revolutionized tight oil production. The Haynesville in Louisiana and Texas provides substantial dry gas production.

| Formation | Location | Primary Production | Depth (ft) | Thickness (ft) |

| Marcellus | PA, WV, OH, NY | Dry Gas | 4,000-8,500 | 50-200 |

| Eagle Ford | TX | Oil, Gas, NGLs | 4,000-14,000 | 50-300 |

| Haynesville | LA, TX | Dry Gas | 10,500-13,500 | 200-300 |

| Bakken | ND, MT | Oil | 8,000-11,000 | 10-120 |

South America: Contains 19% of global shale gas resources

South America’s shale potential is dominated by Argentina’s Vaca Muerta formation, which has shown promising results in early development. The Vaca Muerta is comparable in quality to the Eagle Ford in Texas and has attracted significant international investment. Brazil’s Paraná Basin and Colombia’s Middle Magdalena Valley also hold substantial technically recoverable resources.

Argentina’s Vaca Muerta formation in the Neuquén Basin is South America’s most active shale play, covering approximately 30,000 square kilometers. By 2022, it was producing over 160,000 barrels of oil equivalent per day, with projections for substantial growth as development techniques continue to improve.

Europe: Contains 12% of global shale gas resources

Europe’s shale development has progressed more slowly than North America due to environmental concerns, regulatory challenges, and social opposition. The United Kingdom, Poland, and Ukraine initially showed the most interest in shale development, but progress has been limited. The Baltic Basin spanning Poland and surrounding countries holds significant potential but faces complex geological and regulatory challenges.

Asia: Contains 24% of global shale gas resources

China leads Asian shale development, particularly in the Sichuan Basin where commercial production is underway. The Chinese government has set ambitious targets for shale gas production, though progress has been slower than initially anticipated due to complex geology and challenging topography. Other significant resources exist in Pakistan’s Lower Indus Basin and India’s Cambay Basin.

Australia: Contains 6% of global shale gas resources

Australia’s shale development has focused on the Cooper Basin, which offers potential for both tight gas and shale gas development. The Canning Basin in Western Australia holds significant resources but faces challenges related to remote location and lack of infrastructure. The Beetaloo Basin in the Northern Territory has shown promising early results but development has been slowed by environmental reviews.

Africa: Contains 18% of global shale gas resources

Africa holds substantial shale resources, particularly in South Africa’s Karoo Basin and across North Africa in Algeria, Libya, and Egypt. South Africa has conducted extensive studies of its Karoo Basin resources but has proceeded cautiously with development due to water scarcity concerns. Algeria and Libya’s shale resources remain largely unexplored due to political instability and infrastructure limitations.

Development Challenges

While global shale resources are abundant, development outside North America faces several common challenges:

- Geological Complexity: Many international shale formations exhibit more complex geology than North American basins, requiring adaptations to drilling and completion techniques.

- Water Availability: Hydraulic fracturing requires significant water resources, creating constraints in water-scarce regions like China’s Sichuan Basin, South Africa, and parts of the Middle East.

- Infrastructure Limitations: Many prospective shale regions lack the extensive pipeline networks and processing facilities that enabled rapid development in the United States.

- Regulatory Frameworks: Countries with less developed oil and gas regulations face challenges in establishing appropriate oversight for unconventional development.

- Public Acceptance: Social license to operate remains a significant challenge, particularly in densely populated regions of Europe and Asia.

Key Technological Adaptations for Global Shale Development

- Reduced water fracturing techniques for water-constrained regions

- Smaller pad footprints for densely populated areas

- Integrated production facilities to reduce infrastructure requirements

- Enhanced monitoring systems to address environmental concerns

- Fit-for-purpose completion designs for varied geological conditions

Extraction Techniques and Technologies

The successful development of shale resources worldwide has been driven by continuous technological advancement in extraction techniques. From the early days of vertical wells with limited stimulation to today’s sophisticated horizontal drilling and multi-stage hydraulic fracturing, the evolution of these technologies has transformed previously uneconomic resources into viable energy sources.

Modern Drilling Methods

Modern shale development relies heavily on advanced drilling techniques that maximize reservoir contact while minimizing surface footprint. Horizontal drilling has revolutionized the industry by allowing a single surface location to access significantly more reservoir volume than traditional vertical wells.

A typical modern horizontal well can replace 8-16 vertical wells, reducing surface disturbance by up to 90% while increasing production rates by 300-700% compared to vertical wells in the same formation.

| Drilling Method | Description | Advantages | Challenges | Typical Application |

| Vertical Drilling | Traditional straight-down wellbore | Simpler, lower cost, easier to complete | Limited reservoir contact, higher surface footprint | Conventional reservoirs, exploratory wells |

| Directional Drilling | Controlled deviation from vertical | Accesses reservoirs beneath sensitive areas | Requires specialized equipment, higher cost | Offshore, environmentally sensitive areas |

| Horizontal Drilling | 90° turn to drill along reservoir | Maximizes reservoir contact, reduces footprint | Complex engineering, higher initial cost | Shale formations, tight reservoirs |

| Multilateral Drilling | Multiple horizontal sections from one wellbore | Accesses multiple zones, further reduces footprint | Completion complexity, higher cost | Stacked reservoirs, urban operations |

| Extended Reach Drilling | Ultra-long horizontal sections (>10,000 ft) | Maximizes reservoir exposure, reduces pad count | Technical challenges, torque and drag limitations | Offshore, large-scale development |

Hydraulic Fracturing Process Explained

Hydraulic fracturing, commonly known as “fracking,” is a well stimulation technique used to extract oil and natural gas from tight shale formations where traditional drilling methods alone would be ineffective. The process involves injecting a carefully engineered fluid mixture at high pressure into the reservoir rock to create fractures, allowing hydrocarbons to flow more freely toward the wellbore.

Modern hydraulic fracturing, combined with horizontal drilling, has revolutionized energy production by unlocking vast resources previously considered uneconomical. This technology has transformed global energy markets and significantly increased domestic oil and natural gas production in countries with large shale formations. In the following, we will examine the hydraulic fracturing process step by step.

Well Preparation

Before hydraulic fracturing can begin, a well must be drilled vertically to the depth of the target formation, typically 5,000-10,000 feet below the surface. The wellbore is then extended horizontally through the shale layer, often for distances exceeding 10,000 feet. Multiple layers of steel casing and cement are installed to isolate the wellbore from surrounding rock formations and groundwater aquifers, creating a secure conduit for both the fracturing operation and subsequent production.

Key Protection Measure: The cement casing serves as a critical barrier between the wellbore and groundwater zones, typically extending several thousand feet below the deepest freshwater aquifers.

Perforation

Once the well is properly cased and cemented, the horizontal section within the shale formation is perforated using specially designed shaped charges. These charges create small holes through the casing and cement, extending a short distance into the surrounding shale. These perforations provide pathways for the fracturing fluid to access the formation and for hydrocarbons to enter the wellbore during production.

Modern wells typically employ multi-stage completions, with perforation clusters spaced along the horizontal wellbore to fracture distinct segments of the reservoir in sequence.

Hydraulic Fracturing

The fracturing fluid—typically a mixture of water, proppant (usually sand), and chemical additives—is pumped down the wellbore and through the perforations at pressures exceeding the strength of the rock. This high pressure creates fractures in the shale formation that extend outward from the wellbore. As pumping continues, these fractures propagate further into the formation, creating a network of interconnected pathways.

The proppant particles suspended in the fluid remain in the fractures when pressure is released, “propping” them open to maintain pathways for hydrocarbon flow even after pumping stops.

Flowback and Production

After the fracturing process is complete, the pressure is released, and a portion of the fracturing fluid (known as “flowback”) returns to the surface through the wellbore. This flowback period typically lasts from a few days to several weeks, after which the well begins producing oil and/or natural gas through the propped fracture network.

Throughout the productive life of the well, additional produced water—naturally occurring formation water—will continue to reach the surface along with the oil and gas.

Fracturing Fluid Composition

Hydraulic fracturing fluid is precisely engineered for each well based on the specific geologic conditions of the target formation. While water and sand constitute approximately 95-99% of the mixture, various chemical additives serve essential functions in optimizing fracture creation and hydrocarbon recovery.

| Component | Typical Percentage | Purpose | Common Examples |

| Water | 90-95% | Base fluid that carries proppant into fractures | Fresh water, recycled produced water, brackish water |

| Proppant | 4-9% | Keeps fractures open after pressure release | Sand, ceramic beads, resin-coated sand |

| Friction Reducer | 0.1-0.2% | Reduces pumping friction, allowing higher injection rates | Polyacrylamide polymers |

| Biocide | 0.01-0.05% | Prevents bacterial growth that could produce corrosive byproducts | Glutaraldehyde, quaternary ammonium compounds |

| Scale Inhibitor | 0.01-0.05% | Prevents mineral scale formation that could block fluid flow | Phosphonates, polymeric scale inhibitors |

| pH Adjusters | 0.01-0.1% | Maintains effectiveness of other fluid components | Sodium hydroxide, acetic acid |

| Surfactant | 0.01-0.1% | Reduces fluid surface tension to improve recovery | Ethoxylated alcohols |

| Gelling Agent | 0-0.5% | Increases viscosity to improve proppant transport | Guar gum, hydroxyethyl cellulose |

Industry Transparency: Most operators now disclose the chemical composition of their fracturing fluids through the FracFocus Chemical Disclosure Registry, a publicly accessible database that allows stakeholders to review the substances used in wells across North America.

Water Usage

Water is a critical resource in hydraulic fracturing operations, with significant volumes required for each well. As the industry has matured, water management practices have evolved substantially to address environmental concerns, reduce freshwater consumption, and minimize disposal challenges.

Typical Water Volumes

A modern horizontal well with multi-stage fracturing typically requires between 1.5 million to 16 million gallons (5.7 to 60.6 million liters) of water, depending on:

- Target formation characteristics

- Lateral length

- Number of fracturing stages

- Regional geological conditions

- Operator-specific completion designs

Water intensity has increased over time as operators have moved toward longer laterals with more fracturing stages, typically delivering proportionally greater production results per well.

Water Sourcing Strategies

| Water Source | Advantages | Challenges | Industry Trend |

| Surface Water (rivers, lakes) | Readily available in some regions, established permitting processes | Seasonal availability constraints, competing demands, environmental concerns | Decreasing reliance in water-stressed regions |

| Groundwater | Less seasonal variation than surface water | Potential competition with drinking water sources, aquifer depletion concerns | Stable to decreasing usage |

| Municipal Supplies | Reliable quality and availability | Higher cost, potential community concerns about industrial usage | Limited usage, primarily in urban drilling operations |

| Brackish/Non-potable Water | Reduces freshwater demand, often abundant in oil-producing regions | Treatment requirements, corrosion concerns | Significantly increasing |

| Recycled Produced Water | Reduces both freshwater demand and wastewater disposal | Treatment costs, logistics, compatibility issues | Rapidly increasing, especially in water-stressed basins |

Environmental Considerations and Challenges

This overview examines the primary environmental concerns associated with hydraulic fracturing operations, including water usage, methane emissions, and seismic activity, along with current industry solutions.

Water Concerns and Solutions

Hydraulic fracturing operations require significant volumes of water, typically between 1.5 to 16 million gallons per well. This high water demand raises several environmental concerns, particularly in water-stressed regions where competition with agricultural, municipal, and ecological needs can occur.

Key Water Challenges:

- Large freshwater withdrawals potentially impacting local water supplies

- Chemical additives in fracturing fluids raising groundwater contamination concerns

- Management and disposal of large volumes of produced water

- Surface spills and well integrity failures potentially affecting water quality

Water Usage in Hydraulic Fracturing

| Basin/Region | Average Water Use (million gallons/well) | Water Recycling Rate (%) | Primary Water Source |

| Permian (Texas/New Mexico) | 11.5 | 40-60 | Groundwater, produced water |

| Marcellus (Pennsylvania) | 4.5 | 70-90 | Surface water, recycled |

| Eagle Ford (Texas) | 8.5 | 20-30 | Groundwater |

| Bakken (North Dakota) | 3.5 | 5-15 | Surface water, groundwater |

| Haynesville (Louisiana) | 6.5 | 10-20 | Surface water, groundwater |

Water Management Solutions

| Solution | Description | Benefits | Challenges |

| Water Recycling | Treatment and reuse of produced water for subsequent fracturing operations | Reduces freshwater demand by 30-90%, lowers disposal needs | Treatment costs, scaling issues, variable water quality |

| Alternative Water Sources | Using brackish, produced, or municipal wastewater instead of freshwater | Preserves freshwater resources, potential cost savings | Treatment requirements, corrosion concerns, compatibility issues |

| Waterless Fracturing | Using propane, CO₂, or nitrogen foam instead of water-based fluids | Eliminates water usage, reduces formation damage | Higher costs, safety concerns, limited application |

| Advanced Monitoring | Real-time monitoring of water quality near fracturing sites | Early detection of contamination, improved public trust | Implementation costs, technical limitations |

Methane Emissions and Climate Impact

Methane emissions from oil and gas operations, including hydraulic fracturing, present significant climate concerns due to methane’s potent greenhouse effect – approximately 28-36 times more powerful than CO₂ over a 100-year period. Controlling these emissions is crucial for natural gas to serve as a lower-carbon transition fuel.

Key Emission Concerns:

- Fugitive emissions during well completion and production

- “Super-emitter” sites contributing disproportionately to total emissions

- Impact on the overall greenhouse gas footprint of natural gas

- Challenges in accurate measurement and monitoring

Methane Emission Sources in Hydraulic Fracturing

| Emission Source | Contribution (%) | Primary Causes | Mitigation Approaches |

| Equipment Leaks | 30-35 | Valves, connectors, instruments, compressors | Leak detection and repair (LDAR) programs, equipment upgrades |

| Pneumatic Devices | 20-25 | Gas-powered controllers and pumps | Low/no-bleed devices, electrification, instrument air systems |

| Storage Tanks | 15-20 | Venting from produced water and hydrocarbon tanks | Vapor recovery units, flares, improved tank design |

| Well Completions | 8-10 | Gas venting during flowback | Green completions, reduced emission completions |

| Liquid Unloading | 10-15 | Removing liquids from wells to maintain production | Plunger lifts, velocity tubing, artificial lift systems |

| Other Sources | 5-10 | Dehydrators, compressors, processing equipment | Improved maintenance, equipment upgrades, monitoring |

Induced Seismicity Debates

Seismic activity potentially associated with hydraulic fracturing operations has become a significant concern in several regions. While the fracturing process itself rarely causes felt earthquakes, the deep-well injection disposal of wastewater has been linked to increased seismic events in certain geological settings.

Key Seismicity Concerns:

- Correlation between wastewater disposal wells and increased earthquake frequency

- Public perception and property damage concerns

- Regulatory challenges in managing and monitoring seismic risks

- Scientific uncertainty regarding prediction and prevention

Notable Induced Seismicity Cases

| Region | Period | Maximum Magnitude | Primary Cause | Response |

| Oklahoma, USA | 2009-2016 | 5.8 (Pawnee) | Wastewater disposal wells | Volume restrictions, well closures |

| Texas (Permian Basin) | 2018-Present | 5.0 | Wastewater disposal, hydraulic fracturing | Seismic response protocols |

| Western Canada | 2013-Present | 4.6 | Hydraulic fracturing | Traffic light protocol, monitoring |

| United Kingdom | 2011 | 2.3 | Hydraulic fracturing | Temporary moratorium |

| Ohio, USA | 2011-2014 | 3.0 | Wastewater disposal | Well shutdown, new regulations |

Seismic Risk Mitigation Strategies

| Strategy | Description | Effectiveness | Implementation Status |

| Traffic Light Systems | Protocols with predefined magnitude thresholds triggering operational changes | High when properly implemented | Widespread adoption in high-risk areas |

| Pre-operation Surveys | Advanced geological assessment to identify fault structures | Moderate to high | Increasing adoption |

| Alternative Disposal | Water recycling and treatment to reduce disposal volumes | High for reducing overall risk | Growing implementation |

| Pressure Management | Controlled injection rates and pressures to minimize stress changes | Moderate | Common regulatory requirement |

| Real-time Monitoring | Seismic arrays detecting early signs of fault activation | Moderate | Increasingly required in high-risk areas |

Economic Impact of Gas Shale

A comprehensive analysis of how shale gas development transforms regional economies, enhances energy security, and influences global gas markets.

Economic Impact of Gas Shale

The emergence of economically viable shale gas extraction has fundamentally transformed energy markets and regional economies. This shift has generated significant economic benefits through job creation, enhanced energy independence, and structural changes in global gas pricing mechanisms.

Key Economic Impacts at a Glance:

- Creation of direct, indirect, and induced jobs across multiple sectors

- Reduced energy import dependence and enhanced energy security

- Downward pressure on global gas prices and increased market competitiveness

- Increased tax revenues for local and state governments

- Stimulation of manufacturing sectors through lower energy costs

Job Creation and Regional Development

Shale gas development creates employment opportunities across multiple sectors, from direct drilling and extraction jobs to indirect employment in supporting industries. The economic multiplier effect extends to local businesses, services, and regional infrastructure development.

| Employment Category | Jobs Created per Well | Average Salary | Skills Required | Training Time |

| Drilling Operations | 13-28 | $65,000-$98,000 | Technical, mechanical | 1-3 months |

| Well Completion | 10-15 | $68,000-$82,000 | Specialized technical | 2-4 months |

| Pipeline Construction | 8-15 per mile | $55,000-$75,000 | Construction, welding | 2-6 weeks |

| Engineering & Management | 5-8 | $95,000-$150,000 | Engineering degree | 4+ years |

| Support Services | 15-25 | $45,000-$65,000 | Varied | 1 week-3 months |

Energy Independence and Security

Shale gas development has dramatically altered the energy independence landscape for many countries, particularly the United States. By reducing reliance on imported energy sources, nations can enhance their energy security, improve trade balances, and reduce geopolitical vulnerabilities.

| Country | Pre-Shale Import Dependence (%) | Post-Shale Import Dependence (%) | Change in Energy Security Rating | Trade Balance Impact (Billions USD) |

| United States | 65 | 8 | Significant improvement | +$95.2 |

| China | 42 | 38 | Moderate improvement | +$15.8 |

| Argentina | 18 | -5 (net exporter) | Significant improvement | +$8.3 |

| United Kingdom | 43 | 36 | Minor improvement | +$5.7 |

| Canada | -65 (net exporter) | -78 (net exporter) | Already strong | +$18.5 |

Regulatory Landscape and Policy Implications

The regulatory frameworks governing hydraulic fracturing vary significantly across regions and countries, reflecting different priorities, geological conditions, and political environments. These regulatory approaches continue to evolve as new scientific evidence emerges and public concerns shift.

Key Regulatory Considerations:

- Water management and protection of groundwater resources

- Chemical disclosure requirements and transparency

- Land use planning and surface impacts

- Air quality and emissions control

- Seismic monitoring and risk management

- Well integrity standards and abandonment procedures

Varying Approaches Around the World

Hydraulic fracturing regulations differ substantially across jurisdictions, ranging from complete bans to minimal oversight. These differences reflect varying political systems, environmental priorities, energy security concerns, and public attitudes toward resource development.

| Country/Region | Regulatory Approach | Key Features | Level of Restriction | Recent Developments |

| United States | State-led regulation | Varies by state; disclosure requirements, water management standards | Moderate to Low | Federal methane regulations strengthened; some states increasing oversight |

| Canada | Provincial regulation | Water protection, seismic monitoring, disclosure requirements | Moderate | Enhanced methane regulations, increased transparency requirements |

| European Union | Mixed approach | Precautionary principle, environmental impact assessments | High | Several countries maintain moratoriums or bans |

| United Kingdom | Moratorium | Previously allowed with strict controls; now halted | Very High | Moratorium reinstated after seismic events |

| China | State-directed development | Centralized planning, strategic development zones | Low to Moderate | Accelerating development with improving environmental standards |

| Australia | State-based regulation | Water trigger legislation, regional assessment frameworks | Moderate | Some states maintaining moratoriums, others advancing development |

| Argentina | Provincial oversight | Development-focused, increasing environmental standards | Low | Streamlining regulations to accelerate Vaca Muerta development |

Regulatory Trend Analysis: The global trend shows a gradual convergence toward risk-based regulatory frameworks that maintain core environmental protections while allowing for technological innovation. Many jurisdictions are moving away from prescriptive approaches toward performance-based standards that focus on outcomes rather than specific technologies.

Balancing Economic Benefits and Environmental Protection

Policymakers face the challenge of creating regulatory frameworks that capture the economic benefits of shale gas development while providing adequate environmental safeguards. This balancing act involves addressing multiple stakeholder concerns and establishing appropriate regulatory oversight without stifling innovation or economic growth.

| Policy Approach | Economic Considerations | Environmental Protections | Implementation Challenges | Effectiveness Rating |

| Adaptive Management | Allows development while monitoring impacts | Continuous improvement of standards based on data | Requires robust monitoring and enforcement | High |

| Risk-Based Regulation | Focuses resources on highest-risk activities | Tailored protections based on local conditions | Requires sophisticated risk assessment capabilities | High |

| Co-Regulation | Industry best practices with government oversight | Encourages innovation in environmental protection | Risk of regulatory capture | Moderate |

| Command and Control | Higher compliance costs, regulatory certainty | Prescriptive standards, clear enforcement | May stifle innovation, high enforcement costs | Moderate |

| Local Control | Addresses community concerns, social license | Tailored to local environmental priorities | Regulatory fragmentation, inconsistency | Moderate to Low |

| Moratoria/Bans | Foregoes economic benefits | Eliminates environmental risks | Political volatility, economic opportunity costs | Low for balance, High for protection |

Key Elements of Successful Regulatory Frameworks:

- Transparency and Disclosure: Public access to information about operations, chemicals used, and environmental monitoring data

- Baseline Assessment: Pre-development environmental monitoring to establish reference conditions

- Adaptive Management: Flexible frameworks that evolve based on new scientific evidence and operational experience

- Stakeholder Engagement: Meaningful consultation with affected communities and integration of local knowledge

- Compliance Mechanisms: Effective enforcement capabilities and appropriate penalties for non-compliance

Future of Gas Shale in the Energy Transition

As the world seeks to reduce carbon emissions and combat climate change, the role of natural gas extracted from shale formations remains a topic of significant debate. Understanding its potential contributions and limitations in the energy transition is crucial for developing effective energy policies.

Role in Reducing Coal Dependency

Natural gas from shale formations has played a significant role in reducing coal consumption in electricity generation across several major economies. This shift has contributed to measurable reductions in carbon dioxide emissions, particularly in the United States, where the “shale revolution” has been most pronounced.

| Country/Region | Coal-to-Gas Switching Impact | CO₂ Emissions Reduction | Timeframe | Challenges |

| United States | Significant | 15-20% in power sector | 2005-2020 | Methane leakage, infrastructure lock-in |

| European Union | Moderate | 8-12% in power sector | 2010-2020 | Import dependency, price volatility |

| China | Limited but growing | 3-5% in targeted regions | 2015-2020 | Coal industry strength, resource availability |

| India | Minimal | 1-2% in urban centers | 2018-2020 | Economic barriers, infrastructure limitations |

| Southeast Asia | Variable | 2-8% depending on country | 2015-2020 | Financing, regulatory uncertainty |

Emissions Impact Analysis: When accounting for the full lifecycle emissions, including methane leakage, natural gas from shale provides a 30-50% reduction in greenhouse gas emissions compared to coal for electricity generation. However, this advantage diminishes significantly if methane leakage rates exceed 3.2% throughout the supply chain.

Bridge Fuel Concept and Debates

The characterization of natural gas as a “bridge fuel” in the transition to renewable energy has been both influential and controversial. This concept suggests that natural gas can serve as a temporary solution that reduces emissions while renewable energy technologies mature and scale up to meet global energy demands.

| Perspective | Key Arguments | Timeframe | Proponents | Limitations |

| Bridge Fuel Advocate | Lower emissions than coal, flexible generation, economic benefits | 20-30 years | Industry, some governments, moderate environmental groups | Methane leakage, infrastructure lock-in, limited decarbonization |

| Renewable Accelerationist | Gas delays renewable transition, stranded asset risk, climate urgency | 5-10 years maximum | Climate scientists, progressive environmental groups | Intermittency challenges, storage costs, economic disruption |

| Infrastructure Realist | Repurposing possibilities, hydrogen blending, renovation over replacement | 15-25 years | System operators, policy experts, engineers | Technical constraints, cost uncertainties, regulatory complexity |

| Energy Security Prioritizer | Domestic resources, geopolitical advantage, supply reliability | 25-40 years | National security advisors, certain governments | Climate impact, international agreements, technological obsolescence |

Critical Factors Determining Bridge Fuel Viability:

- Carbon Budget Constraints: Remaining carbon budget to limit warming to 1.5°C or 2°C significantly impacts the acceptable duration of natural gas use

- Renewable Energy Deployment Rate: Speed of renewable energy scaling affects the length of time gas is needed as a transition fuel

- Methane Leakage Control: Effectiveness of methane emissions reduction throughout the gas supply chain

- Carbon Capture Deployment: Development and implementation of carbon capture technologies for gas power plants

- Energy Storage Advancement: Progress in addressing intermittency of renewable energy sources

Integration with Renewable Energy Systems

Natural gas power plants offer grid flexibility that can complement variable renewable energy sources like wind and solar. As renewable penetration increases, the role of gas in the energy system is evolving from baseload to peaking and balancing applications, potentially extending its relevance in a decarbonizing energy landscape.

| Integration Approach | Technological Requirements | System Benefits | Carbon Impact | Economic Considerations |

| Peaking Power | Fast-ramping gas turbines | Grid stability, renewable integration | Moderate – limited operational hours | Higher per-kWh costs, lower capital utilization |

| Hybrid Power Plants | Combined solar/wind with gas backup | Firm power delivery, infrastructure efficiency | Low to moderate – optimized dispatch | Reduced transmission costs, improved capacity factors |

| Hydrogen Blending | Modified gas turbines, pipeline adaptation | Reduced emissions, future-proofing assets | Variable – depends on hydrogen percentage | Minimal short-term costs, gradual transition |

| CCUS Integration | Carbon capture technology, storage infrastructure | Near-zero emissions from gas plants | Very low – up to 90% reduction | High capital costs, efficiency penalties |

| Flexible Demand Response | Smart grid, energy management systems | Reduced peaking requirements, optimized dispatch | Indirect reductions through efficiency | Lower system costs, reduced capacity payments |

System Transformation Pathway: The most promising pathway for gas shale in the energy transition involves a gradual evolution from serving as a coal replacement to providing flexibility services for renewable-dominated grids, and eventually transitioning infrastructure to carry carbon-neutral gases like hydrogen or biogas.

Investment Trends and Market Outlook

The shale gas industry has experienced significant transformations in its investment landscape over the past decade. From rapid expansion and high-risk capital deployment to a more measured approach focused on capital efficiency and free cash flow generation, the sector continues to evolve in response to market forces, technological advances, and environmental considerations.

Major Players and Company Profiles

The shale gas industry has seen significant consolidation in recent years, with major players focusing on optimizing their portfolios, improving operational efficiency, and strengthening their financial positions. These companies represent a mix of integrated oil majors, independent producers, and specialized operators across key shale basins.

| Company | Primary Basins | Production Scale | Financial Strength | Technological Focus | ESG Strategy |

| ExxonMobil | Permian, Appalachian | Very Large | Strong | Advanced analytics, automation | Methane reduction, water management |

| Chevron | Permian, Marcellus | Very Large | Strong | Digital optimization, long laterals | Emissions intensity targets, CCUS |

| EOG Resources | Eagle Ford, Permian, DJ Basin | Large | Strong | Proprietary completion techniques | Zero routine flaring initiative |

| Pioneer Natural Resources | Permian | Large | Strong | Water recycling, well spacing | Net zero target by 2050 |

| Occidental Petroleum | Permian, DJ Basin | Large | Moderate | Enhanced oil recovery, CCUS | Carbon neutrality ambitions |

| EQT Corporation | Marcellus, Utica | Large | Moderate | Digital well planning, electric fracking | Responsible gas certification |

| Chesapeake Energy | Marcellus, Haynesville | Medium | Improving | Operational efficiency, lean drilling | Methane monitoring, RSG initiatives |

Industry Consolidation Analysis: Recent merger and acquisition activity has focused on creating scale, operational synergies, and basin dominance. The trend toward fewer, larger operators is expected to continue as companies seek to optimize capital allocation and strengthen balance sheets to withstand commodity price cycles.

Emerging Technologies and Efficiency Improvements

Technological innovation continues to be a key driver of productivity improvements and cost reductions in the shale gas industry. From advanced drilling and completion techniques to digitalization and automation, companies are increasingly leveraging technology to enhance operational efficiency and reduce environmental impact.

| Technology Category | Key Innovations | Efficiency Impact | Environmental Benefit | Adoption Status | Cost Implication |

| Advanced Drilling | Longer laterals, pad drilling, automated rigs | 15-25% cost reduction | Reduced surface footprint | Widely adopted | Initial increase, long-term savings |

| Completion Optimization | Engineered completions, precise cluster spacing | 10-20% production increase | More efficient resource recovery | Advancing rapidly | Moderate increase |

| Digital Technologies | AI, machine learning, predictive analytics | 5-15% operational improvement | Optimized resource usage | Early adoption phase | Initial investment, long-term ROI |

| Water Management | Recycling systems, produced water treatment | 30-50% freshwater reduction | Reduced freshwater consumption | Growing adoption | Case-dependent economics |

| Emissions Control | Continuous monitoring, vapor recovery, electric fleets | Minimal direct efficiency gain | Significant methane reduction | Accelerating adoption | Increasing, regulatory driven |

| Alternative Fracturing | Waterless fracking, energized fluids, CO₂ foam | Reservoir-dependent | Reduced water usage, potential CO₂ sequestration | Experimental/niche | Currently higher |

Conclusion: Gas Shale’s Evolving Place in Our Energy Future

The shale gas industry stands at a critical inflection point, balancing economic imperatives with environmental responsibilities. As the sector matures, several key trends are shaping its trajectory:

- Financial Discipline: The industry has fundamentally shifted from growth-at-all-costs to sustainable operations that prioritize shareholder returns and balance sheet strength.

- Technological Transformation: Continued innovation in drilling, completions, and digital technologies is driving productivity improvements while simultaneously reducing environmental impacts.

- Consolidation Continuation: The trend toward fewer, larger, and more financially robust operators will likely persist as companies seek economies of scale and operational efficiencies.

- Environmental Adaptation: Rising to meet decarbonization challenges, leading companies are implementing emissions reduction strategies, responsible resource management practices, and exploring low-carbon technologies.

- Energy Transition Integration: Rather than standing in opposition to renewable energy development, forward-thinking shale producers are exploring ways to integrate their operations with the broader energy transition through initiatives like hydrogen production, carbon capture, and methane management.

The future of shale gas will be determined by how successfully the industry can deliver reliable, affordable energy while continuously improving its environmental performance. Companies that lead in operational excellence, technological innovation, and sustainability practices will be best positioned to thrive in an increasingly complex energy landscape.

What are your thoughts on the future of the shale gas industry? Have you observed different investment trends or market developments? Share your perspective in the comments below.

FAQ

What factors most significantly influence investment in shale gas?

Commodity prices remain the dominant factor, but investor sentiment has shifted to emphasize capital discipline, free cash flow generation, and environmental performance. Regulatory frameworks, technological capabilities, and geopolitical factors also play crucial roles in investment decisions.

How is ESG affecting the shale gas industry?

Environmental, Social, and Governance considerations are fundamentally reshaping the industry. Companies are implementing methane leak detection programs, water conservation initiatives, community engagement efforts, and transparent reporting practices. Those with strong ESG credentials increasingly enjoy better access to capital and higher valuations.

What technologies are making the biggest impact on shale economics?

Advanced drilling techniques (longer laterals, pad drilling), precision completions, artificial intelligence for reservoir characterization, automation, and water recycling technologies have collectively reduced break-even prices by 30-50% over the past decade.

Is consolidation good for the shale industry?

Consolidation generally improves capital efficiency, enhances operational scale, reduces overhead costs, and strengthens financial resilience. Larger companies often have greater capacity to invest in environmental initiatives and advanced technologies, though reduced competition may potentially slow innovation.

How will natural gas fit into a low-carbon future?

Natural gas is widely viewed as a transition fuel that can displace coal in electricity generation while providing reliable backup for intermittent renewable sources. However, reducing methane emissions throughout the natural gas value chain is essential to maintain its environmental advantages over other fossil fuels.

What regulatory developments most concern shale gas investors?

Methane emissions regulations, increased scrutiny of water usage and disposal practices, potential carbon pricing mechanisms, and public land drilling restrictions represent significant regulatory concerns. However, policy predictability is often as important as the specific regulations themselves.

Where do YOU stand in the shale gas debate? Is it an essential bridge fuel or a dangerous detour from renewables? Share your perspective below