Did you know the same mineral that stabilizes oil wells also enhances your medical X-rays? Barite’s unique properties make it indispensable across industries—but what drives its global demand, and how is mining becoming more sustainable?

Table of Contents

What is Barite?

Barite is a sulfate mineral known as the heaviest non-metallic mineral. It typically occurs in white or colorless form, but may appear yellow, brown, blue, or green due to impurities. Barite has a vitreous to pearly luster and its hardness on the Mohs scale ranges between 3 and 3.5.

Chemical Composition and Physical Properties

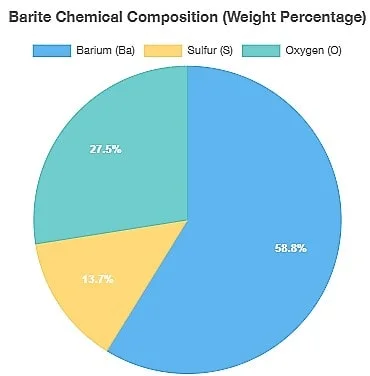

Barite is identified by the chemical formula BaSO₄ (barium sulfate). This mineral is composed of barium, sulfur, and oxygen elements. Below are some of the most important physical and chemical properties of barite.

| Property | Value/Description |

| Chemical Formula | BaSO₄ |

| Specific Gravity | 4.3 to 4.6 g/cm³ |

| Hardness (Mohs scale) | 3 to 3.5 |

| Color | White, colorless, yellow, brown, blue, green |

| Luster | Vitreous to pearly |

| Crystal System | Orthorhombic |

| Fracture | Uneven to conchoidal |

| Transparency | Transparent to translucent |

| Solubility in Water | Very low (approximately 0.0002g in 100g water at 20°C) |

| Melting Point | Approximately 1580°C |

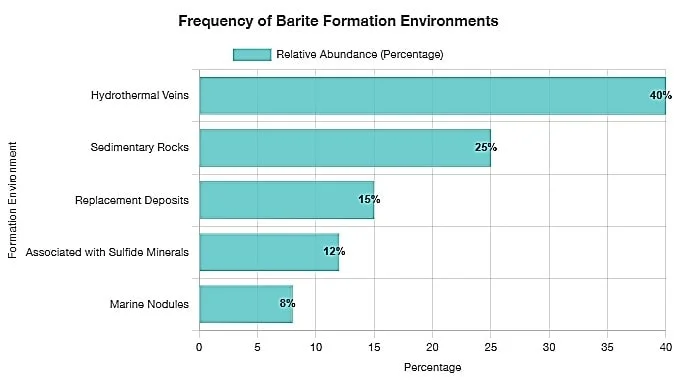

Barite forms in nature through various processes and can be found in diverse geological environments. It commonly occurs in hydrothermal veins, sedimentary rocks, and as an accessory mineral in some metallic ore deposits.

| Formation Environment | Characteristics | Example Locations |

| Hydrothermal Veins | Formation from hot barium-rich solutions flowing through rock fractures | Colorado and Nevada (USA), Çubuk Mahden (Turkey) |

| Sedimentary Rocks | Direct precipitation from seawater or saline lakes | Sedimentary regions of Egypt, Tunisia, parts of Iran |

| Replacement Deposits | Replacement of limestone by barium-rich solutions | Kentucky mines (USA), various mines in China |

| Associated with Sulfide Minerals | Co-occurrence with metallic minerals like galena, sphalerite, and pyrite | Lead and zinc mines in Mexico, Australia |

| Marine Nodules | Formation as nodules on the ocean floor | Gulf of Mexico seabed, Atlantic Ocean |

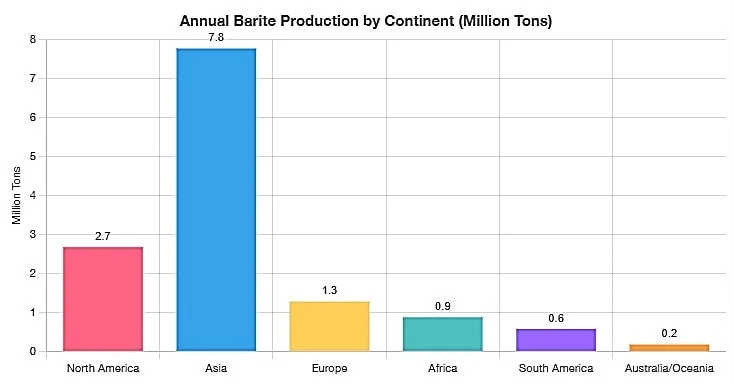

Major barite deposits exist in countries such as China, India, Morocco, USA, Turkey, Iran, and Mexico. China, producing over 3.6 million tons annually, is the world’s largest barite producer.

The Historical Significance of Barite

Barite has a rich history dating back thousands of years. Its journey from an obscure mineral to a crucial industrial material illustrates how human understanding and technological capabilities have evolved over time. The historical significance of barite is not only in its practical applications but also in how it contributed to scientific advancement and industrial development.

Early Discovery and Uses

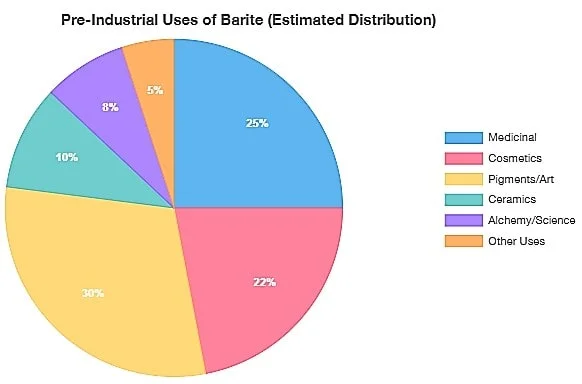

The earliest documented uses of barite date back to ancient civilizations. Archaeological evidence suggests that barite was known to ancient Egyptians, Romans, and Chinese civilizations, who used it for various purposes ranging from medicine to cosmetics and pigments.

| Time Period | Civilization/Region | Uses and Significance |

| 3000-2000 BCE | Ancient Egypt | Used as a white pigment in cosmetics and artwork |

| 1st-5th Century CE | Roman Empire | Used in medicinal preparations and as a weighting agent |

| 8th-14th Century | China | Used in traditional medicine and ceramics |

| Middle Ages | Europe | Alchemists experimented with barite for its unusual weight |

| 17th Century | Italy/Germany | First scientific descriptions by mineralogists |

| 18th Century | Western Europe | Recognized as a distinct mineral; isolation of barium by Sir Humphry Davy in 1808 |

Evolution in Industrial Applications

The industrial revolution marked a turning point in the history of barite usage. As technology advanced, new applications for barite emerged, transforming it from a curiosity into a valuable industrial mineral. The 19th and 20th centuries saw exponential growth in barite mining and consumption as its unique properties became essential to various industries.

| Time Period | Industrial Development | Barite Application | Impact |

| 1850s-1870s | Early Paint Industry | White pigment (lithopone) containing barite | Improved affordability of white paints |

| 1880s-1900s | Medical Diagnostics | First use in X-ray imaging as a contrast medium | Enhanced medical diagnostic capabilities |

| 1920s | Petroleum Industry Growth | Initial use as drilling mud additive | Improved drilling efficiency and well control |

| 1930s-1940s | Rubber and Glass Manufacturing | Filler in rubber and glass products | Enhanced product properties and reduced costs |

| 1950s-1970s | Deepwater Oil Exploration | Standardization of barite in drilling fluids | Enabled deeper and more complex drilling operations |

| 1980s-2000s | Environmental Regulations | Development of high-purity grades | Met stricter environmental standards |

| 2000s-Present | Advanced Manufacturing | Specialized applications in electronics, radiation shielding | Enabling technologies in multiple industries |

The evolution of barite applications demonstrates how a natural resource can find new relevance as technology and industry evolve. From its humble beginnings as a curiosity and pigment, barite has become indispensable in modern industry, with the oil and gas sector currently being the largest consumer.

Historical Milestone: The standardization of barite specifications for drilling fluids by the American Petroleum Institute (API) in the mid-20th century was a pivotal moment that established consistent quality requirements for the industry worldwide.

Global Distribution and Major Deposits

Barite (BaSO₄), an essential mineral for various industries including oil and gas, medicine, and manufacturing, is distributed unevenly across the globe. Its deposits are typically found in sedimentary environments, hydrothermal veins, and as gangue mineral in various ore deposits. Understanding the global distribution of barite resources is crucial for supply chain management, especially given its classification as a critical mineral by many countries.

Global Significance: Barite is considered a critical mineral due to its irreplaceable use as a weighting agent in drilling fluids for oil and gas exploration. Its worldwide distribution and production patterns directly impact energy exploration costs globally.

| Rank | Country | Annual Production (million metric tons) | Percentage of Global Production | Major Deposit Types |

| 1 | China | 3.5 | 37% | Sedimentary, Vein |

| 2 | India | 1.6 | 17% | Bedded, Residual |

| 3 | Morocco | 1.0 | 11% | Sedimentary, Vein |

| 4 | United States | 0.7 | 7% | Bedded, Residual |

| 5 | Kazakhstan | 0.6 | 6% | Vein, Replacement |

| 6 | Mexico | 0.5 | 5% | Vein, Replacement |

| 7 | Iran | 0.4 | 4% | Vein, Sedimentary |

| 8 | Turkey | 0.3 | 3% | Vein, Sedimentary |

| 9 | Russia | 0.3 | 3% | Vein, Replacement |

| 10 | Other Countries | 0.7 | 7% | Various |

North American Barite Resources

North America represents a significant region for barite production, particularly in the United States, Mexico, and Canada. The United States has historically been a major producer, with Nevada hosting some of the continent’s most productive deposits. However, domestic production in the U.S. has declined in recent decades, leading to increased imports from countries like China and India.

Strategic Importance: Despite declining production, North American barite deposits remain strategically important for the region’s energy security, as they provide crucial materials for domestic oil and gas exploration activities.

| Location | Deposit Type | Estimated Reserves (million metric tons) | Average Grade (% BaSO₄) | Active Mines |

| Nevada, USA | Bedded | 15.3 | 94% | 5 |

| Missouri, USA | Residual | 3.7 | 96% | 2 |

| Georgia, USA | Residual | 2.1 | 92% | 1 |

| Nueva León, Mexico | Vein | 7.5 | 92% | 6 |

| Sonora, Mexico | Replacement | 4.8 | 91% | 3 |

| Nova Scotia, Canada | Vein | 1.2 | 95% | 1 |

| British Columbia, Canada | Bedded | 2.4 | 93% | 2 |

Asian and European Deposits

Asia, particularly China and India, dominates the global barite production landscape. China alone accounts for over one-third of global output, with major mining operations in Guizhou, Hunan, and Guangxi provinces. Europe has significant deposits, though smaller in scale, with notable operations in Germany, the United Kingdom, and Turkey.

Market Influence: Asian barite producers, especially China, largely dictate global market prices and availability. European deposits, while smaller, often feature higher purity grades suitable for pharmaceutical and chemical applications.

| Region | Major Locations | Estimated Reserves (million metric tons) | Annual Production (million metric tons) | Deposit Characteristics |

| Eastern China | Guizhou, Hunan | 62.0 | 2.3 | Sedimentary, high grade |

| Southern China | Guangxi, Guangdong | 35.0 | 1.2 | Vein deposits, medium grade |

| India | Mangampeta, Andhra Pradesh | 45.0 | 1.6 | Bedded deposits, high grade |

| Kazakhstan | Zhambyl Province | 18.0 | 0.6 | Vein and replacement deposits |

| Iran | Kerman, East Azerbaijan | 12.0 | 0.4 | Vein deposits, variable grade |

| Turkey | Antalya, Muğla | 9.0 | 0.3 | Sedimentary, medium to high grade |

| Germany | Rhineland-Palatinate | 3.5 | 0.1 | Vein deposits, high purity |

| United Kingdom | Derbyshire, Cumbria | 2.0 | 0.05 | Vein deposits, high purity |

| Russia | Kuznetsk Alatau, Khakassia | 11.0 | 0.3 | Vein and replacement deposits |

Mining and Processing Techniques

Mining extraction and processing of minerals are complex processes that require specialized techniques and advanced equipment. These processes are generally divided into two main categories: extraction methods and beneficiation/processing techniques.

Extraction Methods

Mining extraction methods are generally divided into surface and underground mining. The selection of an appropriate method depends on multiple factors including deposit depth, geometric shape, rock strength, operational costs, and environmental considerations.

Comparison of Different Mining Extraction Methods

| Extraction Method | Advantages | Disadvantages | Primary Applications |

| Surface Mining | Lower cost, higher recovery, greater safety | Extensive environmental impact, depth limitations | Coal, iron ore, copper, gold |

| Underground Mining | Less surface impact, ability to mine at great depths | Higher cost, greater safety hazards, lower recovery | Gold, silver, copper, lead, zinc |

| Solution Mining | Low cost, less environmental disturbance | Limitations on mineral types, longer timeframe | Uranium, copper, gold |

| Marine Mining | Access to new resources | High cost, technical challenges, environmental concerns | Manganese, nickel, copper, cobalt |

Beneficiation and Processing

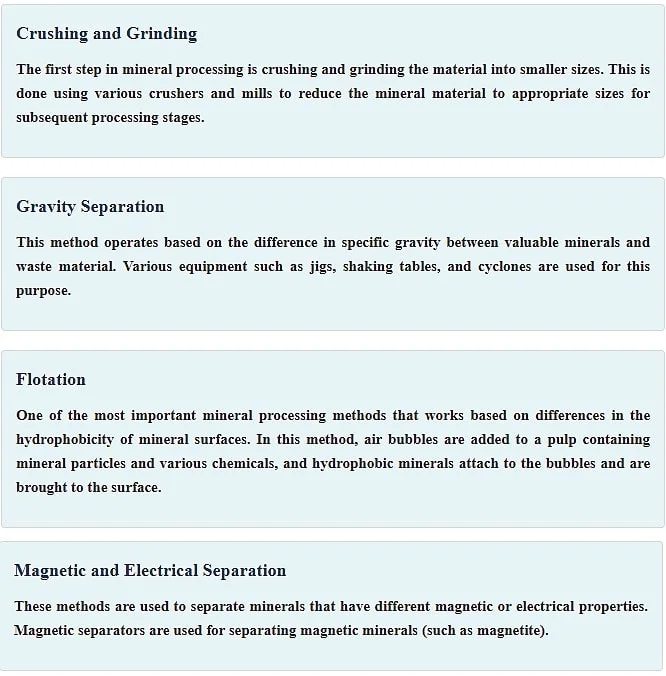

After extracting mineral material from the earth, various processes are employed to separate valuable minerals from waste material. These processes include crushing, grinding, physical and chemical separation techniques.

Various Mineral Processing Methods

| Processing Method | Operating Principles | Suitable Minerals | Efficiency |

| Gravity Separation | Difference in specific gravity | Gold, tin, tungsten | Medium to high |

| Flotation | Difference in hydrophobicity | Copper, lead, zinc, molybdenum | High |

| Magnetic Separation | Magnetic properties | Iron, titanium | High |

| Leaching | Chemical dissolution | Gold, copper, uranium | Medium to high |

Industrial Applications of Barite

Barite (barium sulfate, BaSO4) is a dense mineral that has been widely utilized in various industries due to its unique properties including high specific gravity, chemical inertness, and low solubility. This article explores the diverse industrial applications of barite and its significant role in modern manufacturing and technology.

Barite is a naturally occurring mineral composed primarily of barium sulfate (BaSO4). It’s characterized by its high density (4.5 g/cm³), white to pale yellow color, and low solubility. These distinctive properties make barite valuable across multiple industries. Global barite production exceeds 9 million metric tons annually, with China, India, Morocco, and the United States among the leading producers.

Oil and Gas Drilling: The Primary Use

The oil and gas industry constitutes the largest market for barite, accounting for approximately 80-90% of global barite consumption. Barite is a critical component in drilling fluids, also known as drilling mud.

Key Functions in Drilling Operations:

- Weighting Agent: Barite increases the density of drilling fluid, which counterbalances formation pressure and prevents blowouts.

- Borehole Stability: The weight provided by barite helps maintain the structural integrity of the wellbore during drilling operations.

- Lubrication: Contributes to the lubrication of the drill bit and pipe, reducing friction and wear.

- Cuttings Removal: Helps in suspending and carrying drill cuttings to the surface for removal.

The American Petroleum Institute (API) has established specific standards for barite used in drilling applications. API-grade barite must have a minimum specific gravity of 4.2 g/cm³ and contain less than 250 mg/kg of soluble alkaline earth metals.

Drilling Grade Barite Specifications

| Property | API Specification | Typical Values |

| Specific Gravity | Minimum 4.2 g/cm³ | 4.2 – 4.5 g/cm³ |

| Particle Size | 97% passing through 200 mesh | 98-99% < 75 μm |

| Soluble Alkaline Earth Metals | Maximum 250 mg/kg | 100-200 mg/kg |

| Barium Sulfate Content | Not specified | 92-98% |

Medical Applications: Barium Contrast Studies

Pharmaceutical-grade barite (barium sulfate) plays a crucial role in medical diagnostics, particularly in radiographic imaging of the gastrointestinal tract.

Diagnostic Imaging:

- Contrast Medium: Barium sulfate is radiopaque, meaning it blocks X-rays, creating contrast on radiographic images.

- GI Tract Visualization: Commonly used in barium swallow, barium meal, and barium enema procedures to visualize esophagus, stomach, small intestine, and colon.

- Safety Profile: Due to its extremely low solubility, barium sulfate passes through the digestive system without significant absorption, making it safe for internal use.

Medical Grade Requirements:

- Purity: Extremely high purity levels (>99.5% BaSO4)

- Particle Size: Ultra-fine particles (0.5-5 μm)

- Heavy Metal Content: Strict limits on lead, arsenic, and other contaminants

- Microbial Control: Sterilized or produced under aseptic conditions

Medical-grade barium sulfate is typically manufactured synthetically rather than mined directly to ensure consistent purity and quality control. The pharmaceutical preparations often include additives such as flavoring agents, suspending agents, and pH modifiers to improve patient acceptance and ensure proper distribution throughout the GI tract.

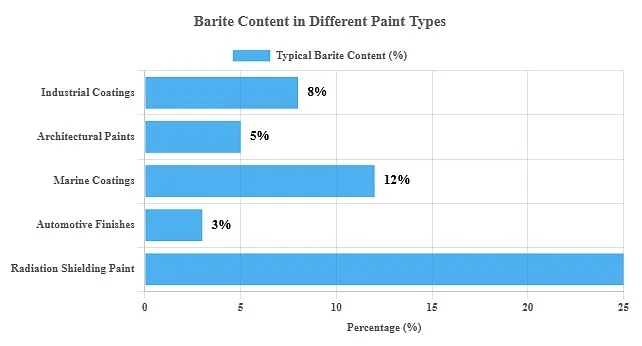

Paint and Coating Industry Applications

Barite is widely used in the paint and coatings industry due to its brightness, chemical inertness, and ability to improve various properties of formulations.

White Pigment Production

While not a primary white pigment like titanium dioxide, barite is used as an extender or filler pigment in paint formulations. Its high refractive index contributes to the opacity and brightness of paints, though to a lesser extent than TiO2. Barite’s chemical inertness makes it compatible with most pigments and binders, allowing for stable color retention.

Filler Material in Paints

As a functional filler, barite provides several advantages in paint and coating formulations:

- Weight and Sag Resistance: Adds density to coatings, reducing sagging and improving application properties

- Chemical Resistance: Enhances resistance to acids, alkalis, and weathering

- Sound Dampening: Increases sound absorption properties in acoustic paints

- Radiation Shielding: Special barite-loaded paints provide protection against X-rays and gamma radiation in medical facilities and nuclear installations

The paint industry typically uses finer grades of barite (often 325 mesh or finer) to ensure smooth application and finish. Micronized barite, with particle sizes below 10 μm, is particularly valued for high-quality coatings.

Other Industrial Uses

Beyond the major applications discussed above, barite serves important functions in several other industries:

Diverse Industrial Applications of Barite

| Industry | Application | Function/Benefit |

| Rubber & Plastics | Filler material | Increases density, improves wear resistance, provides sound dampening |

| Radiation Shielding | Concrete aggregate, panels, plasters | Attenuates gamma and X-ray radiation in medical facilities, nuclear plants |

| Automotive | Brake linings, clutch pads | Increases friction, improves wear resistance, reduces noise |

| Glass Production | Fluxing agent, decolorizer | Improves melt fluidity, enhances clarity, reduces bubbles |

| Paper Industry | Filler, coating pigment | Increases opacity, brightness, and printability |

| Electronics | Component in circuit boards | Provides weight, vibration dampening, flame retardancy |

| Environmental | Heavy metal precipitation | Precipitates radium and other radioactive elements from wastewater |

Emerging Applications:

- 3D Printing: Specialized barite-loaded filaments for high-density printed objects

- Thermal Storage: Phase change materials containing barite for heat retention

- Acoustical Products: Sound-dampening panels and barriers with barite fillers

- Green Building Materials: Eco-friendly concrete alternatives using barite

Economic Impact of Barite

Barite (BaSO₄) is a critical mineral that plays a significant role in various industries, with its economic impact extending far beyond its direct market value. This comprehensive analysis explores global market trends and price dynamics in the barite industry.

Global Market Trends

The barite market has experienced significant fluctuations over the past decade, primarily influenced by the cyclical nature of the oil and gas industry. As of 2023, the global barite market was valued at approximately $2.75 billion and is projected to reach $3.8 billion by 2030, growing at a CAGR of 5.4% during the forecast period.

Regional consumption patterns have shifted considerably in recent years. While North America remains a major consumer despite declining domestic production, Asia-Pacific dominates both production and consumption markets. The Middle East, with its expanding drilling activities, has emerged as a significant consumer of drilling-grade barite.

| Trend | Description | Impact on Market |

| Increasing Demand from Emerging Economies | Countries like India, Brazil, and Indonesia are experiencing growing demand for barite across multiple industries | Expanded market opportunities; potential supply pressure |

| Vertical Integration | Major oil service companies securing their barite supply chains through direct investment in mining operations | More stable supply chains; potential barriers to new market entrants |

| Stricter Quality Specifications | Enhanced requirements, particularly for drilling-grade barite | Premium pricing for high-grade deposits; increased processing costs |

| Industry Diversification | Market players exploring non-drilling applications | Reduced dependency on volatile oil and gas sectors; market stabilization |

| Environmental Regulations | Increasing restrictions on mining and processing activities | Higher operational costs; development of sustainable practices |

Market Impact of COVID-19: The pandemic caused temporary disruptions in the global barite supply chain, with mining operations suspended in several countries. However, the market showed remarkable resilience, rebounding with the recovery of industrial activities and energy sector investments by mid-2021.

Price Fluctuations and Market Dynamics

Barite pricing is characterized by significant volatility, strongly correlated with oil and gas exploration activity. Historical data shows that barite prices typically follow oil price trends with a lag of 3-6 months, reflecting the derived demand nature of the mineral.

Factors Influencing Barite Prices

| Factor | Impact on Pricing | Recent Trend |

| Oil & Gas Drilling Activity | Primary demand driver | Cyclical with energy prices |

| Production Costs | Sets price floor | Increasing due to labor and energy costs |

| Transportation Costs | Significant for bulk mineral | Rising with fuel prices |

| Grade/Quality | Premium for higher grades | Growing premium for API-grade material |

| Supply Concentration | China’s dominance affects global pricing | Diversification efforts ongoing |

| Exchange Rate Fluctuations | Impacts international trade | Increased volatility |

Between 2010 and 2014, barite prices increased sharply due to high oil prices and expanded drilling activity, with drilling-grade barite reaching $180-220 per ton. The oil price collapse in 2014-2016 caused barite prices to fall to $80-110 per ton. Recent years have seen a gradual recovery, with prices ranging from $120-170 per ton for API-grade material as of 2023.

Regional price disparities are significant, with prices in North America typically 20-30% higher than in Asia due to transportation costs and import duties. These price differentials have encouraged the development of regional processing facilities to reduce logistics costs.

Economic Multiplier Effect: The economic impact of barite extends beyond direct sales value. As a critical input for energy exploration, barite availability and pricing indirectly influence energy production costs, affecting numerous downstream industries and overall economic activity in energy-producing regions.

Environmental Considerations

The environmental impact of barite mining and processing represents a critical aspect of the industry’s sustainability profile. As global awareness of environmental concerns increases, stakeholders across the barite value chain are implementing more responsible practices to minimize ecological disruption while maintaining economic viability.

Mining Impact on Ecosystems

Barite mining operations, while economically significant, pose several notable environmental challenges to surrounding ecosystems. The extraction process typically involves open-pit mining techniques that result in substantial land disturbance, with an average mining operation affecting 30-50 hectares per medium-sized deposit. This disturbance includes the removal of topsoil, vegetation clearing, and alteration of natural drainage patterns.

Water quality degradation represents one of the most significant environmental concerns associated with barite mining. The process may contaminate local water sources through:

- Acid mine drainage – When sulfide minerals are exposed to air and water, potentially forming acidic runoff that can leach heavy metals

- Sediment loading – Increased erosion from disturbed areas can lead to heightened turbidity in nearby waterways

- Chemical contamination – Processing agents and naturally occurring associated minerals can enter water systems

Wildlife habitat fragmentation occurs as mining operations disrupt migration corridors and breeding areas. Studies indicate that barite mining sites can experience a 40-60% reduction in biodiversity within the direct mining footprint, with effects extending into buffer zones. The noise, dust, and human activity associated with mining operations further compound these impacts.

| Environmental Impact | Primary Cause | Severity (1-10) | Mitigation Approach |

| Soil erosion | Vegetation removal, slope destabilization | 7 | Contour trenching, progressive reclamation |

| Water contamination | Acid drainage, processing chemicals | 8 | Settling ponds, water treatment systems |

| Air quality degradation | Dust from blasting, crushing, transportation | 6 | Dust suppression, covered transport |

| Habitat loss | Land clearing, infrastructure development | 8 | Habitat conservation offsets, minimized footprint |

| Noise pollution | Blasting, heavy equipment operation | 5 | Sound barriers, schedule optimization |

Sustainable Practices in Barite Production

The long-term landscape alterations resulting from barite mining can be substantial. Without proper reclamation, abandoned mine sites may feature unstable pit walls, waste rock piles, and processing areas that remain disturbed for decades. Modern environmental regulations in many countries now mandate comprehensive closure and reclamation plans, though historical mining sites often remain as environmental liabilities.

The barite industry has increasingly embraced sustainable practices to mitigate environmental impacts while maintaining economic viability. Modern sustainable approaches focus on the entire lifecycle of barite production, from exploration and extraction to processing and site closure.

Resource efficiency improvements have become central to sustainable barite operations. Advanced extraction techniques now allow for the recovery of 15-20% more barite from the same deposit volume compared to methods used a decade ago. These approaches include:

- Selective mining techniques that minimize waste rock generation

- Process optimization that reduces energy and water consumption

- Recovery of barite from previously processed tailings, extracting value from historical waste

Water management systems have evolved significantly, with closed-loop processing becoming the industry standard among leading producers. These systems can achieve water recycling rates of up to 85%, dramatically reducing freshwater consumption and minimizing discharge to the environment. Implementation of these systems has reduced the water footprint of barite processing by an estimated 50-70% over the past 15 years.

| Sustainable Practice | Implementation Cost | Environmental Benefit | Industry Adoption Rate |

| Progressive land reclamation | Medium | Faster ecosystem recovery, reduced erosion | 65% |

| Closed-loop water systems | High | Reduced water consumption, minimal discharge | 48% |

| Energy-efficient processing | Medium-High | Lower carbon footprint, reduced air pollution | 52% |

| Biodiversity management plans | Low-Medium | Preservation of critical habitats and species | 35% |

| Community-integrated planning | Low | Social license, shared infrastructure benefits | 58% |

Reclamation and post-mining land use planning has become increasingly sophisticated. Modern barite mining operations typically begin with detailed closure planning even before extraction commences. This approach allows for:

- Stockpiling of topsoil and growth media for future use

- Progressive rehabilitation of mined areas while operations continue elsewhere

- Development of economically viable post-mining land uses, such as agriculture, forestry, or recreation

Conclusion

Barite, with the chemical formula BaSO₄, is a vital resource in various industries including oil and gas drilling, medicine, and industrial production. This mineral is recognized as the heaviest non-metallic mineral with a high specific gravity (4.3 to 4.6 g/cm³) and unique properties that make it irreplaceable in industry. China, as the largest producer of barite in the world, accounts for more than one-third of global production.

The barite market was valued at approximately 2.75 billion in 2023 and is projected to reach 3.8 billion by 2030. Although consumption of this valuable mineral is heavily influenced by fluctuations in the oil and gas industry, its diverse applications in industries such as medicine, paint manufacturing, rubber, plastics, automotive, and radiation protection ensure its strategic importance.

Significant advancements have been made in sustainable barite extraction and processing, including closed-loop water recycling systems that have reduced water consumption by 50-70%. Progressive reclamation programs and biodiversity management demonstrate the industry’s commitment to environmental protection.

Given barite’s vital role in the global energy supply chain and its diverse applications, this mineral will continue to remain one of the world’s strategically important minerals in the industrial future.

FQA‘s

1. What is barite and what are its characteristics?

Barite is a sulfate mineral with the chemical formula BaSO₄, known as the heaviest non-metallic mineral with a specific gravity of 4.3-4.6 g/cm³.

2. What are barite’s main industrial applications?

Primarily used in oil and gas drilling fluids (80-90% of consumption), with additional uses in medical imaging, radiation shielding, and as fillers in paints and plastics.

3. Which countries lead global barite production?

China produces about 37% of global supply, followed by India (17%), Morocco (11%), United States (7%), and Kazakhstan (6%).

4. How is barite used in the medical field?

Pharmaceutical-grade barite is used as a contrast medium in X-ray imaging of the digestive tract.

5. Why is barite essential for oil and gas drilling?

Its high density makes it an ideal weighting agent in drilling fluids, helping control pressure and stabilize wells.

6. What environmental improvements have been made in barite mining?

Closed-loop water systems, progressive land reclamation, and biodiversity management plans have reduced the environmental footprint by 50-70%.

7. How did COVID-19 affect the barite market?

The pandemic caused temporary supply chain disruptions, but the market rebounded with the recovery of industrial activities by mid-2021.

8. What is the relationship between oil prices and barite demand?

Barite prices typically follow oil price trends with a 3-6 month lag due to its essential role in drilling operations.

9. What emerging applications is barite finding?

New uses include 3D printing filaments, thermal storage materials, acoustical products, and eco-friendly building materials.

How has barite impacted your industry? Share your insights below or ask our experts about sourcing sustainable barite!